|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Current Mortgage Interest Rates Today and Their ImpactThe landscape of mortgage interest rates is constantly changing, influenced by various economic factors. Staying informed about these rates is crucial for anyone considering buying a home or refinancing an existing mortgage. Factors Influencing Mortgage RatesMortgage rates are affected by several key factors that potential borrowers should be aware of. Economic IndicatorsIndicators such as inflation, unemployment rates, and GDP growth play significant roles in determining mortgage interest rates. Generally, higher inflation leads to higher rates, while a stable economy can keep rates lower. Federal Reserve PoliciesThe Federal Reserve's monetary policy, particularly changes in the federal funds rate, directly impacts mortgage rates. When the Fed adjusts rates to control inflation or stimulate growth, mortgage rates typically follow suit. Types of Mortgage Interest RatesUnderstanding the types of mortgage rates can help you choose the best option for your financial situation.

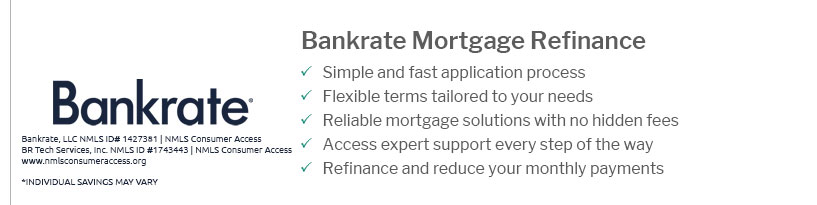

Why Monitor Current Mortgage Rates?Keeping an eye on current 30 year interest rates can help you make informed decisions about buying or refinancing a home. Even a slight change in rates can significantly affect your total loan cost. Refinancing OptionsRefinancing your mortgage can lead to substantial savings, especially when rates drop. Considering a mortgage refinance houston could be a wise financial move if you're looking to reduce your monthly payments or shorten your loan term. FAQ SectionWhat is the current average mortgage interest rate?The current average mortgage interest rate varies daily and depends on factors like the type of loan and creditworthiness of the borrower. It's advisable to check with lenders for the most accurate rates. How do I lock in a mortgage rate?To lock in a mortgage rate, you need to work with a lender who offers a rate lock option. This will guarantee the current interest rate for a specific period, protecting you from future increases during the loan process. Are there fees associated with refinancing?Yes, refinancing usually involves closing costs, appraisal fees, and other charges. It's important to weigh these costs against potential savings to determine if refinancing is beneficial. https://www.forbes.com/advisor/mortgages/mortgage-rates/

What Are Today's Average Mortgage Rates? ; 30-year fixed-rate mortgage: - The average APR for the benchmark 30-year fixed mortgage is 6.77%. - 6.74%. ; 15-year ... https://www.nerdwallet.com/mortgages/mortgage-rates

At 4.25%, the monthly principal and interest cost $1,229.85. So, for a $250,000 mortgage with a 30-year term, cutting the interest rate from 4.25% to 4% saves ... https://www.calhfa.ca.gov/apps/rates/

Lenders can still reserve loans or extend existing rate locks on any loan program ...

|

|---|